The European Union is striving to regulate the crypto market more strictly, and in a broader sense, the European Central Bank has criticized cryptocurrency. Chairwoman Christine Lagarde previously appeared on television and called crypto worthless.

But do you know who the “enemy” is? To demonstrate this, the European Central Bank (ECB) recently published a report entitled “Deciphering Financial Stability Risks in Crypto Asset Markets”.

One thing is certain, and you don’t need a report for that, interest in cryptocurrencies has increased dramatically since Corona. Fortunately, this is also the conclusion of the ECB. They write that, despite the recent decline, the crypto market as a whole is seven times larger than at the beginning of 2020.

Consumers play a big role

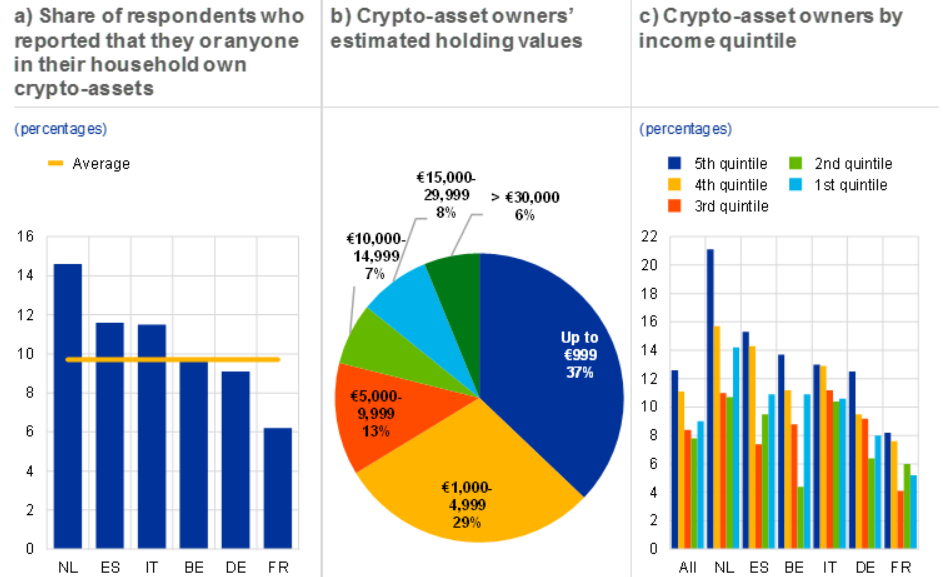

Their report included several consumer surveys in Belgium, Germany, Spain, France, Italy and the Netherlands.

These surveys revealed that about 10% of households could own cryptocurrency. Interestingly, most owners reported owning less than $5,000, while only 6% reported owning crypto worth more than $30,000.

But who actually invests in cryptocurrency? First of all, these are young adult men and people with a high level of education. And this is an interesting statistic: if your financial literacy is ranked at the highest or lowest level, then there is a good chance that someone owns cryptocurrency.

Institutional Investors Want (indirect) Crypto

The report considers not only the role of consumers, but also that of institutional investors. They write that the correlation between cryptocurrency and stock prices increased during (and after) the market stress in March 2020, as well as during the declines of the markets in December 2021 and May 2022.

According to the report, this suggests that the crypto market is more closely tied to traditional risk investments in volatile times, a trend that may be partly due to the greater participation of institutional investors.

If we look at the past 15 days, we can see that Bitcoin has not managed to stay above 30,000 euros, the Bitcoin price is currently 37% lower than at the beginning of 2022. In the same 15-day period, the Shopify stock fell by 76%, Snap fell by 73%, Netflix fell by 70% and even Cloudflare fell by 62%. These are all stocks from big tech companies, so a little bit of Bitcoin in a portfolio might not be such a bad idea at all. According to the ECB, there is certainly a demand among institutional investors for some Bitcoin for their portfolio.

Fidelity Digital Assets also surveyed European institutional investors, 56% of whom reported an exposure to cryptocurrencies. This is an increase of 45% compared to 2020. According to the ECB, this could be due to the fact that government measures could be interpreted as approving crypto assets. For example, since July 2021, German institutional investment funds have been allowed to invest up to 20% of their holdings in cryptocurrency.

More investment opportunities

This is partly made possible by the increasing availability of crypto-based derivatives and securities on regulated exchanges, such as futures, exchange-traded bonds, exchange-traded funds and OTC-traded trusts, which have gained popularity in Europe in recent years.

These products, along with clearing facilities, have made crypto assets more accessible to investors as they can be traded on traditional exchanges. This also ensures that the investor does not have to worry about the safe storage and security of their cryptos. Nevertheless, Europe lags behind the rest of the world, only 20% of crypto funds are on our continent.

Cryptocurrency carries risks

According to the report, the interest of institutional investors in cryptocurrencies will only increase, but this will be associated with more risks. This is partly because European banks offer derivatives on crypto without actually having the crypto in stock. These derivative crypto products track the performance of the various crypto prices. The researchers say that:

“Any crypto-based exposure of institutions, especially if the assets involved are unsecured, could jeopardize capital, with potential repercussions on investor confidence, lending and financial markets, if the exposure is sufficiently large.“

In order to contain these risks and protect investors from themselves (sigh), proposals for stricter regulation have been put forward. These have yet to be approved.

One of the proposals included the Markets in Crypto-Assets Regulation (MiCA) to strengthen the markets and control regulatory uncertainties. The MiCA proposal was already published in September 2020 and has yet to be approved. This means that it will not be applied before 2024, as it is not expected to be applied until 18 months after its entry into force.